Part 1 of a 2-part series.

While I was flicking through Hansard last week looking at the debate over the Policing Courts Crime and Sentencing Bill, I saw in the record of the day a scheduled debate one Critical Minerals. What are “Critical Minerals,” I hear you ask? Well, if you’re reading this on a phone, a tablet or a laptop, you’re using them.

Elementary Chemistry.

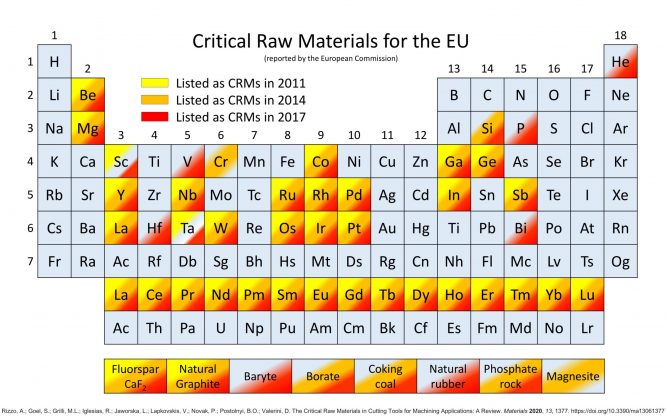

Here’s a quick and very simplified chemistry primer. The Periodic Table of the Elements lists in order according to the number of protons in their nuclei, all the elements to be found on earth. Many of them are metals. Depending on their atomic configuration – number of protons and neutrons in the nucleus, number and arrangement of electrons in the energy levels around the nucleus, they have different properties. They are more or less reactive; they are more or less conductors, they are more or less malleable, ductile, brittle – and so they are used for different things.

As an example, gold does not tarnish because it is extremely unreactive – it does not oxidise, reacting with the oxygen in the air as silver does, and go black. Sodium, a soft, silvery metal, highly reactive and tarnishing very quickly in the air, compounds easily with chlorine, a poisonous greenish gas, to form something most of us eat too much of, but we all need – sodium chloride: salt. It does so through a process called ionic bonding, where sodium loses an electron to become a positively charged sodium ion, and chlorine gains an electron to form a negatively charged chloride ion. Bound inextricably together by electrostatic attraction, sodium and chlorine atoms as sodium chloride salts our seas, seasons our food, and preserves it, and has done for millennia. It’s abundant, and we use it all the time.

What has this got to do with a debate in Hansard?

As technology has developed, we have found more and more uses for what we call “minerals” – the chemical compounds around us, not just the metallic ones, but the non-metallic ones as well. More than five thousand years ago, we started using natron – naturally occurring mixture of sodium carbonate decahydrate (Na2CO3·10H2O, a kind of soda ash) and around 17% sodium bicarbonate (also called baking soda, NaHCO3) along with small quantities of sodium chloride and sodium sulphate, to preserve the bodies of Egyptian pharaohs. We smelted copper with tin to form bronze. We discovered that iron ore, heated and beaten on an anvil, can have its impurities hammered out to make a sword, and later we smelted it with carbon to make steel. We still do.

We also use copper, in our pipes, and aluminium, in many different applications, and non-metallic minerals, such as sand, limestone, gypsum (in plaster) nickel, lithium, clay, feldspar, cobalt, chromium, and many others. Some of those named are single elements, but others are compounds: two or more minerals chemically bonded together, and many of these we have used for centuries, mining them from the earth.

Of late years, we have used, specifically, others which are less common, but whose chemical structure and qualities have enabled us to develop the technology we all rely on. A group of minerals called “the rare earths” – the prettily named lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium and lutetium – are used in petroleum fluid cracking catalysts, metallurgical additives and alloys, glass polishing and ceramics, permanent magnets and phosphors. It is estimated that 40 pounds of rare earths are used in a hybrid car for rechargeable battery, permanent magnet motor and the regenerative braking system.

The Platinum Group Metals – platinum, palladium, rhodium, iridium, osmium and ruthenium – commonly occur together in nature and are among the scarcest of the metallic elements. Platinum is used principally in catalysts for the control of automobile and industrial plant emissions; in jewellery; in catalysts to produce acids, organic chemicals and pharmaceuticals. PGMs are used in bushings for making glass fibres used in fibre-reinforced plastic and other advanced materials, in electrical contacts, in capacitors, in conductive and resistive films used in electronic circuits; in dental alloys used for making crowns and bridges.

Gallium, a silvery semi-metal so soft that it will melt in your hand – trust me: I have some, and it does – is used in integrated circuits, light-emitting diodes (LEDs), photodetectors and solar cells. It has a new use in chemotherapy for some types of cancer. Integrated circuits are used in defence applications, high performance computers and telecommunications. Optoelectronic devices were used in areas such as aerospace, consumer goods, industrial equipment, medical equipment and telecommunications.

Cobalt, used initially mostly in superalloys for aircraft gas turbine engines, in cemented carbides for cutting tools and wear-resistant applications, chemicals (paint dryers, catalysts, magnetic coatings) and permanent magnets is produced principally in Congo, China, Canada, Russia, Australia and Zambia. It is also used in the production of lithium ion batteries – that power the device on which you are reading this. It is found in the negatively charged electrode—or cathode—of almost all lithium-ion batteries used today, playing a crucial role in stabilizing batteries and boosting their energy density.

These are just some examples. But again, what does this have to do with Hansard? What does it have to do with you, for that matter?

The issue, and one to which the UK government has really woken up much too late, is that we do not possess or mine these minerals in these islands. We are, for many of them, and specifically the rare earth and the platinum group metals, all of which are essential for modern technology, completely reliant on imports, and most of those imports are from China.

For cobalt and copper, it is the same: we own neither the territory from which the minerals are produced, nor the means of extraction, nor the infrastructure for the means of production of the technology itself. But China does.

Take cobalt, for example. In 2016 – and it hasn’t changed much since then – China’s foreign cobalt ownership was predominantly in the Democratic Republic of the Congo, the country with the most cobalt mines, which produces intermediate imports for China’s growing cobalt refinery industry. Overseas foreign direct investment provided China with ownership influence over roughly 29% of its cobalt mine and intermediate imports in 2016—which may have reduced the supply risk exposure of China’s refinery industry from a net import reliance of 97% (on cobalt mine and intermediate materials) to an adjusted net import reliance of 68%. China’s global production share jumps from 2% to 14% (for cobalt mine material) and from 11% to 33% (for cobalt intermediate material) when China’s ownership-share of foreign production is added to China’s domestic production share.

Over time China’s foreign direct investment appears to have targeted facilities with progressively larger cobalt production capacities. China’s global production share increases as cobalt material moves downstream (i.e. mine, 14%; intermediate, 33%; refined, 50% in 2016). As a primary motivation of China’s Going Out Strategy is to secure natural resources, then China’s global production share is predominantly reserved for Chinese manufacturers. As a result, this analysis indicates that—for countries outside China—concerns related to critical mineral availability and supply risk may not be confined to minerals produced in China. What this means in a nutshell is that China mines some cobalt, but keeps it mostly for domestic use. The cobalt it used for batteries it manufactures and exports is mostly from cobalt mined elsewhere. It is buying ownership rights to minerals from poorer countries, using the minerals to produce goods for export, and hanging on to its own domestic product and resources. These resources are finite. That is one issue, but there is another.

Unfortunately, like other minerals used by China – it has many mines in Chile and Peru – many of the minerals it uses are mined in poorer countries, with rather less acceptable human rights regulations, very few health and safety regulations, and very little control over the profit that is being made from the mineral extraction which leaves their countries scarred and polluted: extracting, as it were, the maximum of milk with the minimum of moo, and leaving the milch cow exhausted and depleted. It’s just the profit that goes to China.

An example of this is cobalt production in the Democratic Republic of Congo, previously, in colonial times, the Belgian Congo, whose people were subjected to widespread human rights abuses under Leopold II. The Democratic Republic of Congo – where a relation of mine, who works for an international charity running water and sanitation projects, and microloans and start-ups for impoverished families, has seen first-hand some of the issues – is ranked the fifth most fragile state in the world. In 2019, the DRC experienced a welcome precedent for stability with the peaceful transfer of power between an outgoing and incoming president. Sadly, these gains were not maintained: human rights in the Democratic Republic of Congo under President Felix Tshisekedi took a downturn in 2020, against the backdrop of the gains made during his first year in office. Congolese authorities cracked down on peaceful protesters, journalists, and politicians, while using state of emergency measures temporarily imposed due to the Covid-19 pandemic as a pretext to curb protests. Despite the corruption, there has been over a decade of economic growth – but this doesn’t filter down to the majority: most people in the DRC live on less than a dollar a day. Many families depend on subsistence farming and small-scale trading to live. Ethnic violence and massacres have occurred in the eastern part of the country, where an Ebola outbreak is also taking a toll. A scarcity of clean drinking water has led to internal displacement for many. HIV and AIDS have impacted communities, leaving many children orphaned and vulnerable. And there is Covid, of course.

But Congo is a mineral rich country. It produces over 60% of the world’s supply of cobalt, a mineral used to produce lithium-ion batteries used to power electric cars, laptops and smartphone, accounting on its own for two-thirds of global supplies of the metal used in smartphones and electric car batteries. It is, effectively, being pillaged by multinationals corporations, with very little of the profit that make being ploughed back into the company. (It is also Africa’s top producer of copper.)

In 2019, the Guardian reported on ongoing human rights abuses in Congo, where International Rights Advocates are pursuing a lawsuit on behalf of 14 Congolese families. The families accused the companies of knowing that cobalt used in their products could be linked to child labour. The lawsuit, filed in the US, argues that the tech companies had “specific knowledge” that the cobalt sourced for their products could be linked to child labour, saying that the companies failed to regulate their supply chains and instead profited from exploitation.

Apple, Google, Tesla and Microsoft are among firms named in the lawsuit. Other companies listed in the lawsuit are computer manufacturer Dell and the two mining companies who own the minefields where the Congolese families allege their children worked. A subsidiary of the mining giant Glencore owns many of the mines. Glencore supplies the cobalt ore to Umicore N.V, a Belgian company which traces its lineage back to the time of the brutal colonial Congo Free State / Belgian Congo. Umicore refines it and then sells the product on to the five companies in this case. The other key supplier in the region is a subsidiary of Zhejiang Huayou Cobalt, a Chinese company that was the focus of a damning report by Amnesty International and Afrewatch in 2016.

In 2012, Glencore was exposed for purchasing copper mined using child labour. It has worked hard to improve its public image since then, but conditions remain terrible for workers mining some of the most valuable minerals on the planet.

According to the leaked Paradise Papers, Glencore loaned US$45 million to controversial Israeli billionaire Dan Gertler for his help in obtaining mining concessions from state-owned mining company Gécamines at a discounted price, saving Glencore US$440 million. Glencore paid Gertler a further US$960 million to buy his stake in the mines. Gertler is linked to a string of bribery allegations and is subject to criminal proceedings in Switzerland. The US treasury sanctioned Gertler in December 2017, saying his corruption had cost DRCongo US$1.3 billion. Since buying the stakes, Glencore employs about 15,000 people in DRC through its subsidiaries Mutanda Mining and Katanga Mining. It intends to double its cobalt production over the next few years.

Zhejiang Huayou, China’s biggest cobalt refiner, produced 25,000 tonnes of cobalt in 2019, with about 21,400 tonnes coming from its Congo operations. Huayou produces around 25pc of global cobalt chemical products. It produces cobalt hydroxide, cobalt sulphate and lithium anode materials, as well as several copper and nickel products. The Chinese firm is exploring raw material resources in the global market. It acquired in 2017 a 14.7pc stake in Australia-based Nzuri Copper, which is developing the DRC’s Kalongwe copper-cobalt project. Huayou’s copper/cobalt interests in the DRC include Mikas and Congo Dongfang International Mining. It also has smelting and refining operations in China. The London Metal Exchange in July this year added cobalt produced by Huayou to its list of brands approved for delivery, although whether it should have done is a moot point: the lawsuit has not yet terminated, and abuses continue. The court papers for the case, seen by the UK’s Guardian newspaper, give several examples of child miners buried alive or suffering from injuries after tunnel collapse. It’s not just about unsafe tunnels, however.

Last July, Reuters reported that a worker at a Zhejiang Huayou Cobalt Co mine in Democratic Republic of Congo had died of COVID-19 and another confirmed COVID-19 case was being treated in hospital, according to provincial governor Jacques Kyabula Katwe. The employee was the first mineworker to die from COVID-19 in the province, the governor said. Production was continuing at Huayou’s subsidiary Congo Dongfang International Mining (CDM), and the governor said he had sent a team to the site to screen and test contacts of the infected workers. On July 14, the Congolese government ordered copper and cobalt mining companies to stop confining workers on site as they restricted movements due to Covid-19. In many cases workers were given no choice but to either stay and work—confined on site 24 hours a day, seven days a week—or lose their jobs.

As for the human rights abuses, in a response to the lawsuit, Microsoft said it was committed to responsible sourcing of minerals and that it investigates any violations by its suppliers and takes action.

A spokesperson for Google said that the company was “committed to sourcing all materials ethically and eliminating child mining in global supply chains”.

An Apple spokesperson said the company was “deeply committed to the responsible sourcing of materials” and “if a refiner is unable or unwilling to meet our standards, they will be removed from our supply chain. We’ve removed six cobalt refiners in 2019”.

Meanwhile, electric carmaker Tesla will be expanding its relationship with mining company Glencore and will use its cobalt in the new Gigafactories. The company is planning on using the cobalt from Glencore’s mines in the Democratic Republic of the Congo to make lithium-ion batteries at Gigafactories in Berlin and Shanghai.

According to sources close to the matter the Glencore cobalt will also be used in other manufacturing sites that are yet to be announced. (Financial Times, reported June 2020.) The electric car company already uses Glencore’s cobalt in its Shanghai Gigafactory. As the largest industrial cobalt supplier in the world. Glencore could provide Tesla with up to 6,000 tons of cobalt a year under the long-term partnership.

Tesla defended its cobalt sourcing in a company report: “Because Tesla recognizes the higher risks of human rights issues within cobalt supply chains, particularly for child labour in the Democratic Republic of Congo (DRC), we have made a significant effort to establish processes to remove these risks from our supply chain.” Tesla added that it reviews information provided by suppliers for “red flags and risks associated with ethical sourcing.”

Global reduction in reliance on fossil fuels relies on the use of these minerals to replace petroleum burning cars with electrical cars powered by batteries. Unfortunately, the use of batteries itself is fraught with complexity: extraction of the necessary minerals involves illegal mining, human rights violations, corruption and, according to the lawsuit, and in view of cobalt’s known toxicity, birth defects in the workers’ children. Ethically, the move to electric cars is dubious because of the human rights issues, economically they are exploitative of the very poorest in society, and nationally, for the UK, they are a looming disaster, because we are entirely reliant on external suppliers.

And it’s not just cobalt. It’s everything else.

For about the last ten years, as technology has picked up, the pace of extraction of minerals of all types has accelerated, and the scramble for rights over these minerals has become frenetic.

As a personal example, a friend once worked as a deep-sea geochemist, investigating the presence on the sea floor of manganese nodule deposits. Manganese ore is essential to iron and steel production. It’s also used in the making of manganese ferroalloys. Construction, machinery and transportation end uses account for most consumption of manganese, and many deposits in developed countries are mined out: in the US, for example, it has not been produced since 1970. Major producers are South Africa, Australia, China, Gabon and Brazil. The US and the UK are 100 percent import reliant for this mineral.

But manganese nodules, also known as polymetallic nodules (PMN or PN), don’t just contain manganese. They contain mainly manganese, along with other minerals such as iron, nickel, copper, titanium and, guess what, cobalt. Manganese nodules are mainly present in the Pacific and Indian Oceans, in the wide deep-sea basins at depths of 3,500 to 6,500 meters.

In the Seventies and Eighties, although the existence of sub-marine mineral deposits, including manganese nodules, was well documented, (by my partner, amongst others) mining or extracting them was considered to be economically unviable: there were cheaper and easier ways to get at these minerals than by using remote operated mining rigs capable of withstanding several tons per square centimetre of pressure and the corrosive effects of seawater.

Now, however, my brother, a professor of oceanography, and a marine biologist, is fighting to protect these same deep sea mineral deposits – including manganese nodules – from commercial exploitation because of the damage that exploitation is likely to do to sub-marine habitats: times have changed, and as the earth’s supplies of essential minerals on land become depleted, it becomes more economically attractive to mine where it is harder and more expensive to extract the mineral, but there is an abundant supply. And that extraction is beginning. The investment required is massive, but so, financially, could be the rewards.

The global market for deep sea mining – not just for manganese nodules, but for the other two main sea-floor mineral extraction possibilities: cobalt rich crusts (CRC) containing cobalt, obviously, copper, lead, zinc, gold and silver and seafloor massive sulphides (SMS) containing cobalt, vanadium, platinum, tellurium and molybdenum is expected to grow from $650.0 million in 2020 to $15.3 billion by 2030 at a compound annual growth rate (CAGR) of 37.1% from 2020 to 2030.

Three weeks ago, Reuters reported that Canada’s DeepGreen Metals Inc, which aims to produce metals for use in electric vehicle batteries through deep-sea mining, plans to go public in a merger with a special purpose acquisition company (SPAC). The deal with U.S.-based Sustainable Opportunities Acquisition Corp will value the combined entity at $2.9 billion and include a $330 million infusion from investors including Allseas Group SA, Maersk Supply Service and Glencore.

Vancouver-based DeepGreen intends to produce from 2024 metals from polymetallic rocks, (manganese nodules) found deep in the Pacific Ocean, for use in batteries that will power electric vehicles (EVs). The method it will use is deep-sea mining, which critics say is an untested mining method with a largely unknown environmental impact. (A friend of mine isn’t pleased: understatement. He was involved in discovery and classification of several of the hydrothermal vent species which have now been put on the endangered list because of mining, the scaly-foot snail, in the discovery of which he was involved, being one of them.)

And it’s not just DeepGreen and Glencore. China Dialogue Ocean, a small watchdog company, had this report in 2019:

“In August 2019, after the international Seabed Authority (ISA) had convened in July to continue work on regulations to allow the industrial mining of the ocean floor, China extended its domain over the deep sea.

The United Nations organisation headquartered in Kingston, Jamaica, approved the country’s fifth mining contract, meaning China holds more mining claims than any other nation. China now has the right to explore and potentially exploit 238,000 square kilometres (almost the size of New Zealand) of the deep sea in areas outside national jurisdiction for cobalt, nickel, copper and other valuable minerals.

To date, the ISA has issued 30 exploration licences to multinational corporations, start-ups and state-backed companies that cover more than 1.3 million square kilometres of the seabed. China, which has been one of the ISA’s biggest financial benefactors, also signed a memorandum of understanding with the organisation to establish a joint deep sea training and research facility in Qingdao, to be operated by the State Oceanic Administration. China’s growing influence comes at a pivotal time for the ISA. The secretary-general, Michael Lodge, private mining contractors and pro-mining states are pushing to complete a “mining code” by the end of 2020 so exploitation of the seabed can commence.

The stakes are existentially high.”

“The stakes are existentially high” says the report, noting, do not forget, that the International Seabed Authority is being financed by China, to which it has given seabed mining licenses. Yes, they are. There have been delays in the process, because of Covid: everything has had to be put on hold, and perhaps that means that the already beleaguered oceans have had a brief reprieve. But there is absolutely no doubt that China’s exploitative practices – and not just China: Glencore and other mining companies are exploitative as well; it’s just that China has bigger stakes than everyone else – will continue. And unlike in the Democratic Republic of the Congo, where at least there is a lawsuit going through to fight exploitative practices, there is no help for the oceans once these mineral deposits begin to be mined.

We still haven’t got to Hansard have we? I’m sorry. We will now.

At about 10pm, on Monday 15th, Tory MP Alexander Stafford, vice-chair of the all-party parliamentary group for critical minerals, opened a debate on the use of critical minerals in the UK’s renewables future. He commented that “as was the case with my two hydrogen Adjournment debates, I am pleased to announce that this is the first debate in the UK Parliament dedicated to critical minerals.”

He continued:

“Critical minerals have long been overlooked by successive Governments and by this House—the mantra of “out of sight, out of mind” is apt. Awareness of where our critical minerals come from and what they are used for is low, however. The Government are waking up to the fact that the race for critical minerals security is the new great game. Urgent action must be taken now to safeguard the future prosperity of the United Kingdom and the west in the spheres of the economy, defence and energy. With the upcoming COP26 in Glasgow and the G7 summit in Cornwall, there could not be a better time to do so.

It is vital that this House is made aware of the significant threat to our economy and our post-covid and post-Brexit recovery if we run out of the critical minerals needed to supply our low-carbon industries of the future. The UK’s 10-point economic plan makes an assumption that the international supply of these minerals is sufficient to service every country’s needs in our global race to avoid climate change. I would like to inform the House that that is clearly not the case.

What are critical minerals and what are they used for? In simple terms, these are the minerals that are vital for low-carbon industrial capabilities, but which face supply chain vulnerability. The Critical Minerals Association has split the definition of critical minerals into three subsections: critical minerals, which are important for industrial strategy and consist of minerals such as lithium, cobalt and rare earths; technology metals, which are bulk metals such as copper that are not susceptible to supply chain vulnerability, but are important nevertheless for the UK’s industrial objectives; and strategic minerals, which have potential defence importance. Those three groups of critical minerals are ubiquitous in their use, and that is part of the problem.

In fact, critical minerals are becoming more and more important by the day. Our renewables and telecommunications technology of the future requires an ever-increasing amount of critical minerals. Without them, our society just cannot function. With global demand at this scale, shortages present a real threat to our economy and to our society. In the past five years, we have seen the mass commercialisation of satellite and drone technology, led by British companies such as Blue Bear Systems, all of which rely on critical minerals. Likewise, advanced robotics for British manufacturing, which is crucial to my seat of Rother Valley in South Yorkshire and places across our country, require more than 40 different critical minerals. It is incredibly important that British industry thrives in the post-Brexit and post-covid era. For that to happen, factories and plants in the Rother Valley region must stay at the cutting edge of their sector, with the best equipment and secure, efficient supply chains, thus staying competitive and retaining their reputation for the highest-quality products.

The most visible everyday examples of the importance of critical minerals are mobile phones and electric cars. Our ultra-modern smartphones, boasting touchscreens, cameras and 5G, use a huge number of critical minerals, including potassium, tin, copper, tungsten and advanced aluminium. Electric vehicles are often hailed as the future of renewable transport, but they are key users of critical minerals. Each car on average uses 100 kg of copper, rare earth for the magnets and lithium, nickel, cobalt, manganese and graphite for the batteries. Many people are surprised to learn that a solar panel relies on 16 different minerals and metals.

An equally important part of the UK’s renewables future is the wind turbine, with the Prime Minister envisioning that we shall become the Saudi Arabia of Wind-power.”

(As an aside, Johnson is certainly the doyenne of wind-power: the master of the art of hot air. Presumably he’d prefer not to be the “Saudi Arabia” of wind-power, given the association of that country with human rights abuses, but then again, maybe that IS what was meant.)

“I share his enthusiasm for the role that wind can play in powering the UK and in reducing our carbon emissions,” continued Stafford, “but to meet the Prime Minister’s objective of having every home in the UK powered by wind turbines by 2030, experts indicate that we will need to increase our output of energy from 10 GW to 40 GW by 2030. That will require building a new wind turbine every single day until 2030. To achieve that, we need more than 26,000 tonnes of rare earths and more than 4 tonnes of copper. The UK Government must acknowledge that the construction of renewable energy technology is inextricably linked to the supply of critical minerals. We must take action accordingly to protect our energy sector and the generation of power.

Importantly, seven points in the Government’s 10-point plan for the green recovery are dependent on a secure green supply of critical minerals. Herein lies the challenge for the United Kingdom. We are facing a two-pronged threat. The first threat is that as demand rockets for the use of critical minerals in the technology of the future, there is a global shortage, which would affect our economy and livelihoods, our energy supply, our environmental agenda, our security and defence, and basically the way we live our lives.

The second threat is that our current suppliers of critical minerals are not dependable or sustainable. I shall name two countries in our critical minerals supply chain in order to demonstrate that fact. The first is involved in the mining of critical minerals, and the second in the midstream processing. The Democratic Republic of the Congo is not a dependable source of minerals for the UK to rely on. It is politically unstable, and Chinese influence is concerningly strong in mining areas. It is not a sustainable source of minerals either, with the DRC home to low environmental standards and frequent human rights violations against local people and children. In fact, there is currently a class action lawsuit against the big technology companies, including Apple, Google, Dell, Microsoft, and Tesla, which stand accused of operating supply chains that use cobalt mined by children.

The second country in our critical minerals supply chain is the People’s Republic of China, and it is in the midstream, where the communist PRC dominates, that we face our greatest threat. Clearly, we are totally dependent on China’s good will, from processing and refining to beneficiation. For instance, China mines only 1% of the world’s cobalt, but refines 65% of it. It mines 12% of the world’s manganese but refines 97% of it, as well 89% of the world’s graphite. China’s absolute control of the critical mineral midstream is so strong that graphite from the UK is sent to China for beneficiation, and then bought back from China at the component section of the supply chain. That is absurd. Of the 172 gigafactories being built in the world at this moment, 130 are in China.

It is estimated that by 2030 the world’s demand for lithium will mean that global production is 1.4 million tonnes a year in deficit. Graphite will be 8 million tonnes in deficit, cobalt 800,000 tonnes in deficit, and nickel 400,000 tonnes in deficit. If China controls the midstream of those minerals, and is building over three times more gigafactories than the rest of the world put together, it is only logical that China will serve its industrial requirements before the rest of the world, and before the United Kingdom.”

This debate was scheduled for the day the Policing Bill was discussed. It began at 10pm, after a full day of extremely contentious debate about that Bill, and after the issues over the Everard protests the previous weekend. Arguably, it was one of the most important debates that could be had, bearing as it does on the country’s technological future. But Stafford was almost on his own in the House. Anne Marie Trevelyan, one of the Ministers for Business Development replied after Stafford’s speech at 10.26. Again, there was almost no-one there. Meanwhile, as this matter of critical importance to the country’s future is discussed, the media ignored it, and the debate itself was shoved into a late night slot where it could be ignored. Stafford, although a Tory, and, it has to be said a wretched speaker, was master of his subject, and demonstrated a clear understanding of the issues – issues which the EU, for example, has been working on for some years now. But there was no-one there to listen.

Tomorrow: where does the UK stand in terms of production?

Image credit:

Bogdan Postolnyi, CC BY 4.0, via Wikimedia Commons

Excellent article. On a very important subject. One that I’ve only become aware of myself since doing work with the DRC this year. If it’s any consolation I’ve nagged my MP about this (linking critical minerals and China’s strategy in Africa to build influential relationships with key mining areas/ companies /governments … to the UK’s waning presence as we drastically reduce the overseas aid budget. Which has definitely given us positive influence in places like DRC). Look forward to seeing more on this challenging topic.

More is on its way! A lot of what’s happening is linked to China’s Belt and Road initiative – and it’s happening in Europe too, with those countries such as Serbia which are not in the EU.